These days, too many successful, wealthy individuals and families are simply not getting the advice that’s most appropriate to help them achieve their key financial goals.

There are a number of reasons for this. But one main culprit is that, overall, there are a relatively small number of financial advisors we would describe as extremely talented and deeply caring professionals.

So, it’s a good time to ask yourself: How good is the financial advice I’m getting these days?

FOUR TYPES OF ADVISORS

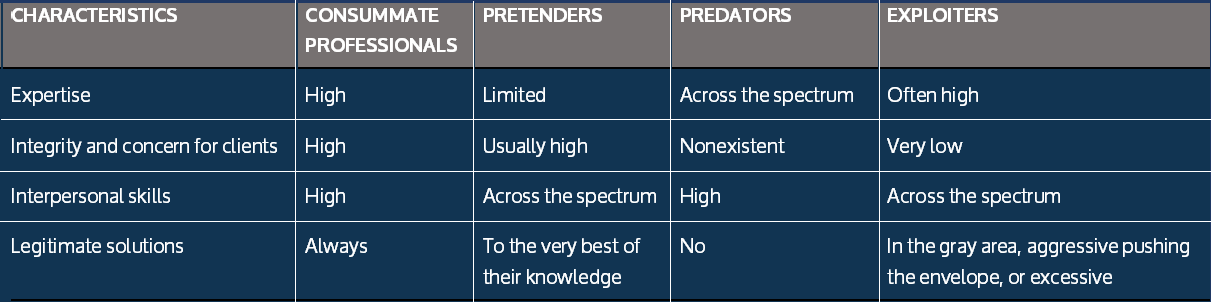

To make smart decisions about your wealth, you want to be sure you’re working with true experts. That means professionals who are both committed to your well-being and best interests, and extremely technically capable in investments and advanced planning. These are advisors we call consummate professionals.

Unfortunately, there are three other types of advisors operating today—and we strongly suggest you steer clear of them!

Pretenders want to do a very good job. They have great intentions. The problem: They lack the knowledge and capabilities to do so. Pretenders simply aren’t familiar with many of the more advanced and sophisticated wealth-building and wealth-protecting solutions you may need to pursue your goals. Advisors who are Pretenders are not bad people. To the contrary, they tend to be intelligent, hardworking and well-meaning. They want to do what is best for their clients, but from an objective vantage point, they are just not capable. Their earnest hard work does not change the fact that a great many of them probably are not able to provide you with the high-level, sophisticated tools, strategies and products that are almost always necessary to become meaningfully wealthier, and they probably aren’t adept at the strategies that are so critical to protecting your wealth.

Exploiters are often technically adept—highly skilled in advanced financial strategies. The problem: The financial and legal strategies they often turn to are technically legal—but highly questionable. Thus, there is often a good possibility that the strategies they advocate will blow up on you—often years after you’ve taken their advice. Put simply, Exploiters are not looking out for your best interests.

Predators are criminals. Their objective is to separate you from your wealth using cunning, guile and duplicity. Predators may or may not be technically sophisticated. However, they’re superbly capable of being manipulative and building rapport and trust.

The key differences among the four types of professionals are summarized in this chart.

KEY DIFFERENCES

KEY DIFFERENCES

Clearly, you want a consummate professional on your side—and there are a few steps to help you gain greater confidence that you are working with one.

The way that most of the affluent and the accomplished find exceptional financial advisors is via introductions from professionals they work with. Example: If you need an exceptional money manager, your accountant may know trusted experts he or she can introduce you to. Or if you have an estate tax issue for which life insurance is the best solution, your trusts and estates lawyer likely knows leading life insurance agents.

Going to professionals who have proven themselves to you can be a very powerful way to find other consummate professionals. When accountants or lawyers refer you to a financial advisor, they are putting their reputation and professional judgment on the line. This is not something they are likely to do unless they feel the financial advisor is a consummate professional.

Another consideration is whether the financial advisor is a thought leader. That is, he or she is recognized as a leading authority by other professionals, the wealthy and successful, and even competitors. By identifying true thought leaders, you increase the likelihood of working with some of the most erudite professionals in their fields.

NEXT STEPS

Are you working with a consummate professional today? We hope so. If your advisor focuses on aligning your wealth with your key financial values and goals—and does so with the help of advanced solutions and a team of experts—it’s likely that you are!

One of the best ways to deal with a situation where you’re just “not completely sure” or you “feel a little uncertain” is to conduct a stress test. This is a process of critically evaluating key aspects of your current financial situation and how they are being managed. Or it may involve carefully assessing a particular strategy or product you are considering and “putting it through its paces” before deciding whether to move ahead.

Stress testing gives you the opportunity to correct mistakes or use solutions and products that can do a lot more to help you accomplish your goals. Simply put, stress testing often makes a lot of sense if you want to avoid financial advisors who are Pretenders, Predators or Exploiters.

Fidato Wealth LLC is a Registered Investment Adviser. This brochure is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Fidato Wealth LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Fidato Wealth LLC unless a client service agreement is in place. Copyright 2018 by AES Nation, LLC. If you are not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are notified that any review, copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately by e-mail or by telephone and (ii) destroy all copies of this message. Please note that trading instructions through email, fax or voicemail will not be taken, as your identity and timely retrieval of instructions cannot be guaranteed. If you do not wish to receive marketing emails from this sender, please send an email to sayhello@fidatowealth.com.

DOWNLOAD A PDF VERSION OF THIS ARTICLE HERE